In recent years, direct deposit has become a preferred method of payment for millions of Americans. It’s convenient, fast, and secure, allowing employers and government programs to electronically transfer funds into an individual’s bank account. If you’ve come across the term “$697 direct deposit,” you’re probably wondering what it refers to and why it’s making waves. In this article, we will explain everything you need to know about the $697 direct deposit, why it is important, who qualifies for it, and how it affects you.

Related: Are $697 Direct Deposit Checks Real Or Fake?

What is $697 Direct Deposit?

The “$697 direct deposit” refers to a recurring payment sent directly to an individual’s bank account, typically as part of a government benefit or assistance program. In many cases, it’s linked to specific stimulus payments, unemployment benefits, or other economic relief measures. These payments are generally part of an initiative by federal or state governments to provide financial relief, especially during times of economic distress.

For instance, in 2021 and 2022, several COVID-19 relief programs included direct payments to eligible individuals, and the $697 figure has surfaced in discussions related to these programs. These funds might be a part of expanded unemployment benefits or special COVID-19 relief packages designed to help citizens weather financial hardships.

Key Contexts for the $697 Direct Deposit

While the exact context of a “$697 direct deposit” may vary, it most commonly appears in the following situations:

- Stimulus Payments: After the COVID-19 pandemic, the U.S. government issued a series of stimulus payments to provide financial relief to citizens. Some people received payments in the form of direct deposits of amounts like $697.

- Unemployment Benefits: In some states, extended unemployment benefits included additional weekly payments, which could sum up to amounts like $697.

- Child Tax Credit: In certain cases, $697 may have been a part of monthly installments issued as part of the expanded Child Tax Credit (CTC) in 2021.

How Does Direct Deposit Work?

Direct deposit is a secure electronic transfer of funds from one account to another. The key advantages of direct deposit include:

- Speed: Transfers typically happen in a matter of minutes or by the next business day.

- Security: Since the funds are transferred electronically, there is less chance for loss or theft compared to paper checks.

- Convenience: You don’t have to go to a bank or cash a check—funds are directly available in your account.

When you’re receiving a $697 direct deposit, it’s likely because you’ve provided your banking details (account number and routing number) to the agency or employer making the payment. The funds are automatically transferred into your account on the designated date.

Who Qualifies for it?

Eligibility for the $697 direct deposit depends on the specific program or initiative in question. Let’s break down the most common scenarios:

- COVID-19 Stimulus Payments:

- If you qualify for COVID-19 relief payments, the amount you receive may vary depending on your income, household size, and other factors. The government issued payments ranging from $600 to $1,400, and in some cases, people received smaller amounts like $697 due to specific eligibility thresholds or the way payments were distributed.

- Unemployment Benefits:

- Those receiving unemployment benefits during the height of the pandemic might have seen additional weekly payments on top of the standard state unemployment benefits. These extended benefits could have been worth around $697 or higher depending on the state and specific programs available.

- Child Tax Credit (CTC):

- In 2021, the government enhanced the Child Tax Credit, providing monthly payments to qualifying families. If you had one child or more, you may have received monthly direct deposits of around $697 or more, depending on your circumstances.

- State-Specific Payments:

- Several states offered their own economic relief programs, with direct deposit amounts varying by state. For example, some states provided payments to help with rent, utilities, or groceries. While the specific amount differed, $697 could be one of the payment amounts issued by these programs.

Example of How the Deposit Helps Families

Imagine a single mother with two children, receiving $697 monthly through the expanded Child Tax Credit. This direct deposit helps her cover essential expenses such as groceries, child care, and rent. In many cases, these payments provide crucial financial support for families who are still recovering from the economic disruptions caused by the pandemic.

How to Set Up Direct Deposit

To set up direct deposit, you’ll need to provide your bank account details to the entity making the payment. This could be your employer, a government agency, or a financial service provider. Here’s how to set up direct deposit:

- Obtain a Direct Deposit Form: Most employers and government agencies provide a direct deposit form where you’ll input your account information.

- Provide Your Banking Information: You’ll need your bank’s routing number and your account number. This information can be found on your check or by logging into your online banking account.

- Submit the Form: After filling out the form, submit it to your employer or the relevant government agency for processing.

- Verify the Transfer: Once set up, verify that the transfer has been made successfully. Most payments will show up in your account on the date specified.

The Benefits of Direct Deposit for Recipients

Direct deposit offers multiple advantages that benefit recipients, particularly for those who receive government assistance or other periodic payments:

- Faster Access to Funds: Direct deposit ensures quicker access to funds compared to waiting for a paper check to arrive by mail.

- No Bank Visits Required: You don’t need to visit the bank to deposit a check. The money is automatically transferred to your account.

- Reduced Risk of Fraud: Direct deposits are safer than paper checks, which can be lost or stolen.

- Easy Record Keeping: Electronic transactions are easier to track and manage, making it simple to keep an eye on your finances.

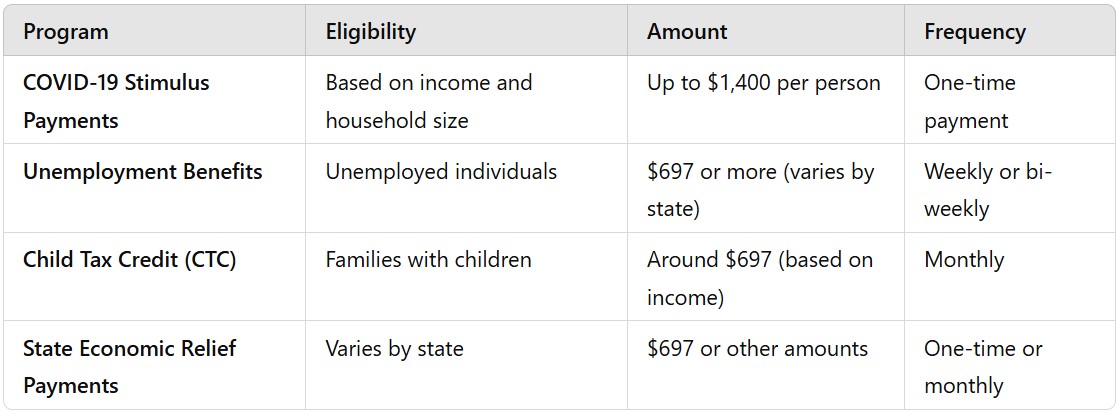

Table Overview

Here is a table summarizing the most common programs that could provide a $697 direct deposit:

FAQs About $697 Direct Deposit

1. What is the deposit for?

It’s a recurring payment made directly to your bank account, often related to stimulus checks, unemployment benefits, or the Child Tax Credit.

2. How can I receive a $697 direct deposit?

You need to be eligible for a government program that offers such payments, and you must provide your bank details to the payer.

3. Is the $697 payment a one-time or recurring payment?

It depends on the program. Some payments like the Child Tax Credit are monthly, while others like stimulus checks are one-time payments.

4. Can I track the $697 direct deposit?

Yes, most payments will show up in your bank account with the relevant description, and you can track your payment status through the payer’s website.

5. How long does it take for it to arrive?

Direct deposits generally take between 1-3 business days, depending on the payer and your bank.

6. Will I get a $697 direct deposit every month?

Not necessarily. The frequency of payments depends on the specific program you’re enrolled in.